Lazy portfolios are designed to perform well in most market conditions. Most contain a small number of low-cost funds that are easy to rebalance. They are 'lazy' in that the investor can maintain the same asset allocation for an extended period of time, as they generally contain 30-40% bonds, suitable for most pre-retirement investors.[note 1]

Note: Historical performance for many of the 'lazy portfolios' is available on our site's blog. See Portfolios - Financial Page.

Two fund portfolio

It is possible to retain access to the broad US and International markets, as well as bonds, using only two funds. Rick Ferri has proposed a two-fund portfolio containing the total world stock market, and a diversified US bond market index fund as follows [1].

Rick Ferri's Two Fund Portfolio[1]| % Allocation | Fund | Mutual Fund | ETF Fund (ER) |

|---|

| Investor's (ER) | Admiral's (ER) |

|---|

| 40% | Vanguard Total Bond Market Index Fund | VBMFX (.16%) | VBTLX (0.05%) | BND (.035%) |

| 60% | Vanguard Total World Stock Index Fund | VTWSX (.21%) | - | VT (.11%) |

Three fund lazy portfolios

Main article: Three-fund portfolio

There are a number of popular authors and columnists who have suggested 3 fund lazy portfolios. These typically consist of three equal parts of bonds (total bond market or TIPS), total US market and total international market.

In addition, consider that there are several close alternatives to these funds, especially when purchasing through vanguard. For example, consider that the 'Vanguard Inflation-Protected Securities Fund' also has a short term alternative, 'Vanguard Short-Term Inflation-Protected Securities Index Fund' (tickers VTIPX or VTAPX) which can offer slightly less volatility in NAV.

Note that while the '% allocation' are different from those listed below, these funds typically make up the core of Vanguard's Target Retirement and Lifestrategy funds.[note 2]

Three-fund lazy portfoliosTaylor Larimore's Three-fund portfolio[note 3]| % Allocation | Fund | Mutual Fund | ETF Fund (ER) |

|---|

| Investor's (ER) | Admiral's (ER) |

|---|

| - | Vanguard Total Bond Market Index Fund | VBMFX (.16%) | VBTLX (0.05%) | BND (.035%) | | - | Vanguard Total Stock Market Index Fund | VTSMX (.15%) | VTSAX (.04%) | VTI (.03%) | | - | Vanguard Total International Stock Index Fund | VGTSX (.18%) | VTIAX (.11%) | VXUS (0.09%) |

Scott Burns' Couch Potato portfolio / Andrew Tobias' Three Fund portfolio[2]| % Allocation | Fund | Mutual Fund | ETF Fund (ER) |

|---|

| Investor's (ER) | Admiral's (ER) |

|---|

| 33% | Vanguard Inflation-Protected Securities Fund | VIPSX (.20%) | VAIPX (.10%) | - | | 34% | Vanguard Total Stock Market Index Fund | VTSMX (.15%) | VTSAX (.04%) | VTI (.03%) | | 33% | Vanguard Total International Stock Index Fund | VGTSX (.18%) | VTIAX (.11%) | VXUS (0.09%) |

Rick Ferri's Lazy Three Fund Portfolio[1][note 4]| % Allocation | Fund | Mutual Fund | ETF Fund (ER) |

|---|

| Investor's (ER) | Admiral's (ER) |

|---|

| 40% | Vanguard Total Bond Market Index Fund | VBMFX (.16%) | VBTLX (0.05%) | BND (.035%) | | 40% | Vanguard Total Stock Market Index Fund | VTSMX (.15%) | VTSAX (.04%) | VTI (.03%) | | 20% | Vanguard Total International Stock Index Fund | VGTSX (.18%) | VTIAX (.11%) | VXUS (0.09%) | |

|

Core four portfolios

As proposed by Rick Ferri on the Bogleheads® forum, the Core Four are four funds which form the 'cornerstone' of a portfolio. Using Vanguard funds these four low-cost, total market funds would be:

Core-Four Portfolio, Funds| Fund | Mutual Fund | ETF Fund (ER) |

|---|

| Investor's (ER) | Admiral's (ER) |

|---|

| Vanguard Total Bond Market Index Fund | VBMFX (0.16%) | VBTLX (0.05%) | BND (0.035%) |

| Vanguard Total Stock Market Index Fund | VTSMX (0.15%) | VTSAX (0.04%) | VTI (0.03%) |

| Vanguard Total International Stock Index Fund | VGTSX (0.18%) | VTIAX (0.11%) | VXUS (0.09%) |

| Vanguard REIT Index Fund | VGSIX (0.26%) | VGSLX (0.12%) | VNQ (0.12%) |

Rick proposes that investors first determine their bond allocation. With the remaining funds, allocate 50% to US stock, 40% to international and 10% to REIT.[3] For example, for 60/40 and 80/20 portfolios, you would end up with the following [1]:

Core-Four Portfolio, Asset AllocationsDesired

Stock/Bond

Allocation | Vanguard Total

Bond Market

Index Fund | Vanguard Total

Stock Market

Index Fund | Vanguard Total

International Stock

Index Fund | Vanguard

REIT Index

Fund |

|---|

| 60/40 | 40% | 30% | 24% | 6% |

|---|

| 80/20 | 20% | 40% | 32% | 8% |

|---|

|

Rick stresses that the exact allocation percentages aren't important, to the nearest 5% is fine.[4]

The core-four is just a low cost foundation for your portfolio. Tembo 2 4 18. You could add a slice of value stocks (US and/or International). You could split the bond portion between Treasury Inflation Protected Securities and nominal bonds, which would result in a slightly more conservative version of David Swensen's model portfolio (less international stock and less REIT, but otherwise the same four base funds plus TIPS.

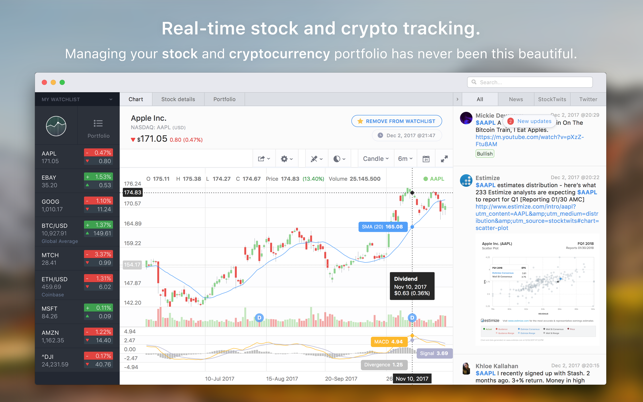

Stockfolio Stocks Portfolio 1 4 35

More lazy portfolios

Beyond the simple 3- and 4-fund lazy portfolios are more complex portfolios. These are still 'lazy' in that they contain enough bonds (typically 30-40%) to allow the investor to maintain the same AA for much of the accumulation phase of their lives. The more complex funds add REITs, and 'slice and dice' the US and/or International stocks, adding large and small value to the mix. It is worth noting that in some of the cases outlined below, a simpler portfolio may be able to accomplish similar goals. For example, a small and value tilt away from the market may be accomplished by adding a small cap value fund, thus 'tilting' from a total stock market fund. Proxie 2 4 1 – http debugging proxy google chrome.

Bill Schultheis's 'Coffeehouse' portfolio

This simple 7-fund portfolio was made popular by Bill Schultheis' book The Coffeehouse Investor. He advocates 40% in a total market bond fund and 10% each in various stock funds. More information can be found at The Coffeehouse Investor. The Coffeehouse Portfolio contains only 10% international stocks (17% of total equities). It slices up the domestic portion, but uses a total international fund.

| Asset Class | % Allocation |

|---|

| Large Blend | 10% | | Large Value | 10% | | Small Blend | 10% | | Small Value | 10% | | Total International | 10% | | REIT | 10% | | Total Bond | 40% |

|

William Bernstein's 'Coward's' portfolio

William Bernstein is the author of several books including The Intelligent Asset Allocator and The Four Pillars of Investing. He introduced the Coward's Portfolio in 1996. The 'coward' refers not to the investor's risk tolerance but to the strategy of hedging one's bets and having slices of a number of asset classes. This portfolio is similar to the Coffeehouse Portfolio except that short term bonds are used, and the international portion is divided into equal slices of Europe, Pacific and Emerging markets.

| Asset Class | % Allocation |

|---|

| Total Stock Mkt | 15% | | Large Value | 10% | | Small Blend | 5% | | Small Value | 10% | | Europe | 5% | | Pacific | 5% | | Emerging Markets | 5% | | REIT | 5% | | Short Term Bond | 40% |

|

Stockfolio Stocks Portfolio 1 4 36

Frank Armstrong's 'Ideal Index' portfolio

Frank Armstrong, author of The Informed Investor, proposed this portfolio for an MSN Money article. It contains a smaller allocation to bonds, and a much larger allocation to international stocks (in fact the equities, excluding REIT, are split 50/50 between domestic and international). Like Bernstein he advocates short term bonds. If the domestic slices were replaced by a total market fund, this portfolio would be very close to the 3-Fund portfolios, with a slice of REIT added.

| Asset Class | % Allocation |

|---|

| Large Blend | 7% | | Large Value | 9% | | Small Blend | 6% | | Small Value | 9% | | Total International | 31% | | REIT | 8% | | Short Term Bond | 30% |

|

David Swensen's lazy portfolio

David Swensen is CIO of Yale University and author of Unconventional Success. His lazy portfolio uses low-cost, tax-efficient total market funds, a healthy dose of real estate, and inflation-protected securities (TIPS).[5]

| Asset Class | % Allocation |

|---|

| Total Stock Mkt | 30% | | Intl Developed Mkt | 15% | | Emerging Markets | 10% | | Real Estate | 15% | | US Treasury Bonds | 15% | | TIPS | 15% |

|

Permanent Portfolio

Stockfolio Stocks Portfolio 1 4 32

The Permanent Portfolio was devised by free-market investment analyst Harry Browne in the 1980s as a buy-and-hold portfolio that contains a healthy allocation to gold. The portfolio holds equal allocations of domestic stocks, gold, short-term treasury bonds, and long term treasury bonds.[6]

Forum members Craig Rowland and J. M. Lawson have written a book, 'The Permanent Portfolio: Harry Browne's Long-Term Investment Strategy, detailing every aspect of the Permanent Portfolio.

Stockfolio Stocks Portfolio 1 4 30

The portfolio can be implemented with an investment in a low cost US total stock market index fund, along with direct investments in gold bullion coins, US treasury bills, and US treasury bonds. It can also be implemented with low-cost exchange-traded funds. See Blackrock iShares for an ETF version of the portfolio.

Permanent Portfolio US Permanent Portfolio| % Allocation | Asset class |

|---|

| 25% | US total stock market | | 25% | Gold bullion | | 25% | US treasury bills | | 25% | US long-term treasury bonds | |

Notes

- ↑The term Lazy portfolios has been popularized by Paul B. Farrell, who writes MarketWatch columns about various simple portfolios.

- ↑ See Three-fund_portfolio for more information on 3-fund portfolios.

- ↑Taylor Larimore was an early advocate of this approach, which he described in 1999 in a Morningstar posting, Which is better, 15 funds or 4?. The fourth fund is a money market fund used for cash management. The allocation percentages of the portfolio should be tailored to each investor's time-frame, risk tolerance and personal financial situation.

- ↑ Rick has stated that 'The mix between U.S. stocks and international stocks can be changed to suit your preference for dollar exposure. Another option is to swap the total bond market index fund for an investment-grade corporate bond index fund that provides higher yield or a Treasury Inflation Protected (TIPs) fund the provides inflation protection.'

See also

- Madsinger monthly reports, monthly returns for several portfolios

References

- ↑ 1.01.11.21.3Three Simple Index Fund Portfolios

- ↑Couch Potato Cookbook

- ↑Rick Ferri looking to internationalize his portfolio, Rick Ferri, direct link to post.

- ↑The Core Four, Rick Ferri, direct link to post.

- ↑Asset allocations are from: 3 Investment Gurus Share Their Model Portfolios, Chris Arnold, NPR.org, October 17, 2015. Viewed October 30, 2015.

- ↑Permanent Portfolio - Early Retirement Extreme Wiki

External links

- Couch Potato Cookbook, from assetbuilder.com - A set of lazy portfolios containing from 2 to 10 funds.

- Bogleheads® forum topic: The Three Fund Portfolio

- Lazy Portfolios, Google Sheets source for charts (Core four, David Swensen).

Portfolio return data

- Lazy Portfolios at MarketWatch - Comparative returns of numerous lazy portfolios compiled by Paul B. Farrell, lazy portfolios story archive, and discussion board.

- The Couch Potato Portfolios, from assetbuilder.com - Construction and returns for the Couch Potato portfolios.

- Portfolios, from site blog.

| Introduction to investing |

|---|

Asking portfolio questions • Behavioral pitfalls • Importance of saving early • Importance of saving rate • Investing start-up kit • Investment philosophy • Investment policy statement • Percentage gain and loss • Risk | | Asset classes |

|---|

Bonds • Callan periodic table of investment returns • CDs • Domestic/International • Money markets • Stocks • Treasury Inflation Protected Securities | | Funds |

|---|

ETFs vs mutual funds • Index fund • Indexing • Lazy portfolios • Mutual fund • Mutual funds and fees • Mutual funds: additional costs • Vanguard target retirement funds | | Managing a portfolio |

|---|

Accounts for children • Asset allocation • Asset allocation in multiple accounts • Building a non-US Boglehead portfolio • Comparing investments • Managing a windfall • Prioritizing investments • Rebalancing • Tax loss harvesting • Tax-efficient fund placement • Taxable account | | Financial advice |

|---|

Financial planner • Investment adviser • Robo-adviser | | Non-US investors |

|---|

Getting started for non-US investors • My portfolio: seeking advice • Building a non-US Boglehead portfolio • Investing start-up kit for non-US investors • Investment philosophy for non-US investors • Simple non-US portfolios |

|

| Sample portfolios |

|---|

Approximating Vanguard target date funds • Lazy portfolios • Three-fund portfolio • Two-fund portfolio • Slice and dice • Slice and dice international | | Portfolio management |

|---|

GnuCash • How to build a lazy portfolio • Investment policy statement • Lump sum vs DCA (Dollar cost averaging) • Passively managing individual stocks • Prioritizing investments • Rebalancing • Short term portfolio management (6 months) • Short term portfolio management (1 year) • Short term portfolio management (5 years) • Using a spreadsheet to maintain a portfolio • Systematic investing • Tax loss harvesting • Using open source software for portfolio analysis • Value averaging | | Portfolio withdrawals |

|---|

Matching strategy • Safe withdrawal rates • Withdrawal methods | | Asset classes |

|---|

US stocks • Non-US stocks • Real Estate • Bonds • Money markets • Alternate asset classes |

|

Retrieved from 'https://www.bogleheads.org/w/index.php?title=Lazy_portfolios&oldid=69539'